Study Overview: In Fall 2025, TradePending surveyed 1,003 vehicle owners across the United States to understand what drives consumers to dealership websites, what frustrates them during the car shopping process, and which digital tools actually influence their decision to visit a dealership in person.

Key Finding: Car shoppers come to your website with three specific goals: research inventory, value their trade-in, and calculate payments. Dealerships that streamline their sites around these priorities convert more traffic into showroom visits.

Understanding What Today’s Car Shoppers Really Want

Every year, car shoppers tell us the same thing: they come to dealership websites with clear goals in mind. They’re not browsing aimlessly. They’re there to research inventory, understand what their current car is worth, and see what they can afford next. Yet many dealership websites clutter the experience with too many calls-to-action, complicated tools, and features that frustrate shoppers instead of helping them move closer to a purchase decision.

Our latest survey results confirm what we’ve suspected for years: success online still comes down to clarity, transparency, and simplicity. Dealerships that streamline their websites around the key “jobs to be done” not only attract more visitors but also convert them into customers faster and with less friction.

According to TradePending’s 2025 survey of over 1,000 vehicle owners, 57% of car shoppers check their trade-in value multiple times during the sales cycle. This behavior signals that consumers are actively comparing offers and need quick, trustworthy valuations backed by real market data. When your trade-in tool requires too many steps or delivers unrealistic numbers, shoppers abandon your site and take their business to Carvana, CarMax, or private buyers, which 53.6% of consumers now prefer over local dealerships.

The data also reveals that consumers want simple payment calculators that set realistic expectations without requiring credit applications upfront. In fact, 40.4% of shoppers cite lack of transparency as their biggest frustration with online payment tools, while another 23.2% complain about too many required inputs or steps. These pain points represent opportunities for dealerships willing to simplify their approach and prioritize user experience over data collection.

Surprisingly, the research also shows that consumers respond positively to the human touch in digital experiences. More than half (53.9%) say personalized video messages from salespeople increase their likelihood of visiting your dealership, while 74.1% find monthly vehicle value updates useful for staying engaged with dealers long-term.

In this post, we’ll break down what car shoppers truly value most when visiting dealership websites, how these insights can transform your digital strategy, and practical tips for improving both customer acquisition and retention. Each finding includes actionable recommendations you can implement immediately to improve your website’s performance and capture more leads.

Q1: The Features That Matter Most on Dealership Websites

What Car Shoppers Want Most from Your Website

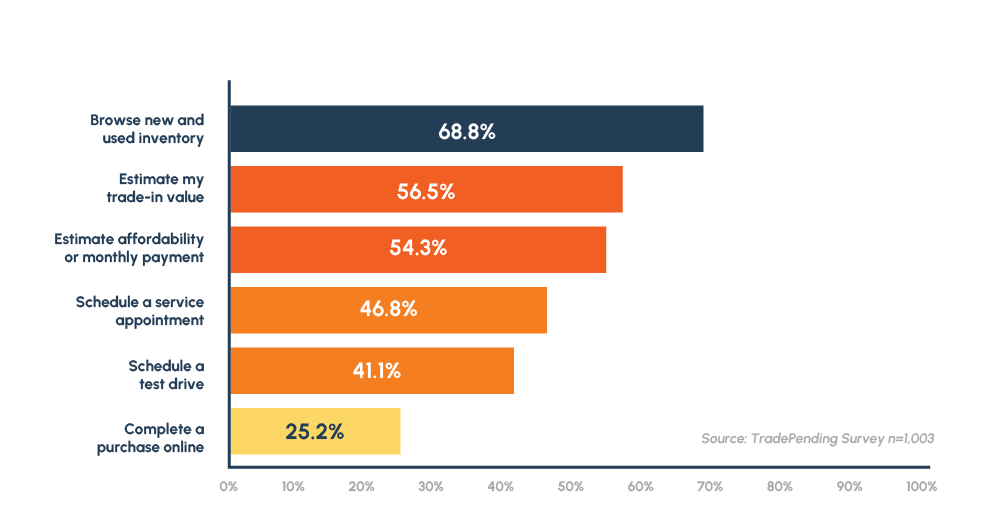

When we asked vehicle owners which features they find most valuable on dealership websites, three priorities emerged as clear winners. According to TradePending’s 2025 survey, 68.8% of consumers ranked browsing new and used inventory as their top priority, followed by 56.5% who want to estimate their trade-in value, and 54.3% who want to estimate affordability or calculate monthly payments.

Question: When visiting an auto dealership’s website, which of the following features or services would you find most valuable?

These top three features aren’t surprising, but the data confirms what many dealers overlook: shoppers want focused, streamlined experiences rather than websites packed with every possible feature. The gap between these top priorities and secondary features is significant: while nearly 7 in 10 shoppers prioritize inventory browsing, only 46.8% care about scheduling service appointments, 41.1% want to schedule test drives, and just 25.2% are interested in completing a purchase entirely online.

Inventory Research Remains the Foundation

The fact that 68.8% of consumers rank inventory browsing as their most valuable website feature confirms that your vehicle listings are the cornerstone of your digital strategy. Shoppers want to see what’s available, filter by their preferences, and get detailed information about specific vehicles without navigating through complicated menus or slow-loading pages. But inventory alone isn’t enough to capture serious buyers.

Trade-In Valuation: The Second Most Important Tool

With 56.5% of consumers prioritizing trade-in valuation tools, the message is clear: shoppers view their current vehicle as a critical part of the buying equation. This finding becomes even more significant when combined with another key insight from our research — 57% of car shoppers check their trade-in value multiple times during the shopping process. This means your valuation tool needs to be immediately accessible, require minimal information to generate an estimate, and deliver numbers backed by real-time market data rather than outdated book values.

Payment Calculators: Essential but Often Problematic

More than half of consumers (54.3%) want to estimate affordability or calculate monthly payments before contacting a salesperson or visiting your showroom. However, as we’ll explore in Q4, traditional payment calculators often create more frustration than value when they demand too much information or set unrealistic expectations about monthly costs. The key is providing payment ranges that help shoppers understand affordability without requiring credit applications upfront.

What This Means for Your Website Strategy

The implications are straightforward: your homepage and navigation should prioritize these three core functions above everything else. If your website currently features ten different call-to-action buttons competing for attention, you’re creating decision paralysis rather than guiding shoppers toward conversion.

To have the highest-performing website, focus on the three things customers most want to accomplish: research inventory, value their trade-in, and calculate a payment. The call-to-action buttons should be limited, nudging shoppers to the items they care about most—valuing their car and understanding how much they can afford.

Secondary features like service scheduling (46.8%), test drive appointments (41.1%), and online purchase completion (25.2%) should be easily accessible but not competing with these primary conversion paths. The data shows that while some consumers appreciate these options, they’re not the driving factors that bring shoppers to your website in the first place.

The highest-performing dealership websites create clear visual hierarchy that nudges shoppers toward inventory research, trade-in valuation, and payment estimation. When these tools are fast, simple, and deliver accurate information, they build trust and move consumers closer to scheduling a visit or submitting a lead.

Q2: Why More Than Half of Consumers Avoid Trading at Local Dealerships

The Trade-In Trust Gap Dealers Must Close

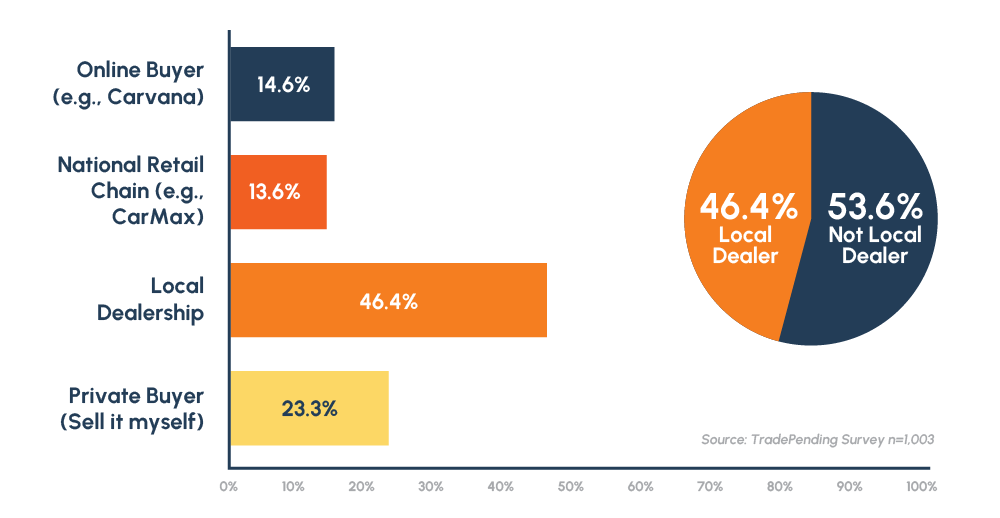

One of the most striking findings in our research reveals a significant challenge for traditional dealerships: when asked which type of buyer they would consider first for trading in their vehicle, only 46.4% of consumers chose local dealerships. This means 53.6% of potential trade-in customers prefer alternative options — including online buyers like Carvana (14.6%), national retail chains like CarMax (13.6%), and private buyers (23.3%).

Question: When trading in your next car, which type of buyer would you consider first??

Breaking Down the Competition

According to TradePending’s 2025 survey of over 1,000 vehicle owners, the trade-in landscape has shifted dramatically. Nearly one in four consumers (23.3%) would consider selling their vehicle privately before approaching a dealership, indicating that many shoppers believe they can get better value through direct sales despite the additional time and effort required.

Online buyers like Carvana captured 14.6% of first-choice preferences, while national retail chains like CarMax attracted 13.6%. Combined, these alternative channels represent more than a quarter of the market (28.2%), competing directly with local dealerships on the promise of convenience, transparency, and competitive offers.

Why Consumers Choose Alternatives Over Local Dealers

The majority of people prefer not to trade in their car with a local dealership, instead preferring the private market, Carvana, and CarMax. This preference stems from several factors that dealerships can address:

- Transparency concerns: Many consumers believe they’ll receive lowball offers from dealers who aren’t transparent about how they calculate trade-in values.

- Trust issues: Years of negative publicity around dealership negotiations have created skepticism about whether local dealers offer fair prices.

- Convenience perception: Companies like Carvana have successfully positioned themselves as easier and faster than traditional dealership trade-ins, even when that’s not always the case.

- Instant offers: Alternative buyers often provide immediate valuations online, while many dealership websites still require in-person appraisals before providing numbers.

How to Win Back the 53.6% Who Look Elsewhere First

To win those buyers over, you must advertise your transparent, competitive, and quick trade-in process. Here’s how:

Offer instant online valuations: Your website should provide immediate trade-in estimates backed by real-time market data, not vague ranges that require in-person visits to refine. When 56.5% of consumers rank trade-in valuation as one of their top three website priorities (Q1), your tool needs to deliver instant value.

Emphasize transparency: Clearly explain how you calculate trade-in values and what factors influence your offers. Show consumers that your numbers are based on actual market data, not arbitrary dealer decisions.

Highlight your competitive advantages: You can often offer more for trade-ins than Carvana or CarMax because you can retail the vehicle on your own lot. Make this advantage clear in your messaging.

Streamline the process: If consumers perceive that Carvana is faster and easier, prove them wrong. Show exactly how simple your trade-in process is—from online valuation to final offer—and eliminate unnecessary steps that create friction.

Build trust through customer testimonials: Feature real stories from customers who were surprised by your competitive trade-in offers. Social proof combats the negative perceptions many shoppers hold about dealer trade-ins.

The 46.4% who still choose local dealerships first represent your loyal base, but the 53.6% who look elsewhere first represent massive untapped opportunity. By addressing their concerns about transparency, fairness, and convenience, you can recapture a significant portion of this market and increase your trade-in acquisition volume.

Q3: Why 57% of Shoppers Check Trade-In Values Multiple Times

The Trade-In Research Cycle Dealers Must Support

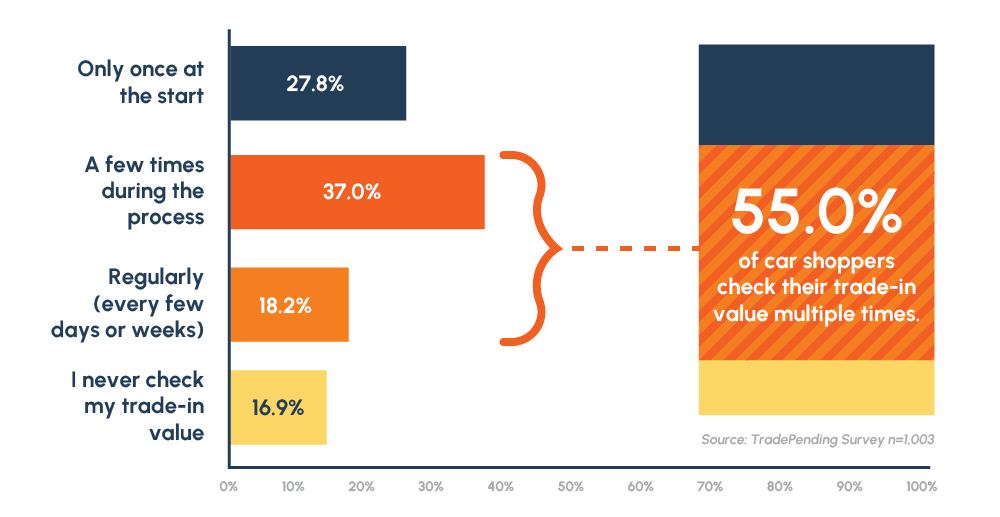

Car shoppers don’t check their trade-in value once and move on, they’re actively monitoring and comparing offers throughout their entire shopping journey. According to TradePending’s 2025 survey of over 1,000 vehicle owners, 57% of consumers check their vehicle’s value multiple times during the sales cycle, with only 27.8% checking just once at the start and 16.9% never checking at all.

Question: During your vehicle shopping process, how often do you check or update your trade-in value?

Breaking Down the Research Behavior

The data reveals three distinct shopper segments based on their trade-in research habits:

Active Researchers (57%): This majority group checks their trade-in value repeatedly throughout their shopping process. Within this segment, 37% check “a few times during the process,” while 18.2% check “regularly (every few days or weeks).” These consumers are clearly comparison shopping, monitoring market fluctuations, and looking for the best possible deal.

Single-Check Shoppers (27.8%): More than one in four consumers check their trade-in value only once at the start of their shopping journey. These shoppers typically use that initial valuation to set their budget and expectations but don’t actively track changes or compare multiple offers.

Non-Checkers (16.9%): Nearly 17% of consumers never check their trade-in value online. This segment may prefer in-person appraisals, plan to keep their current vehicle, or simply haven’t discovered the value of online trade-in tools yet.

Why Multiple Checks Matter for Your Website Strategy

The fact that 57% of people check their vehicle’s value multiple times during the sales cycle has significant implications for your dealership website. Every time a shopper returns to check their trade-in value, you have another opportunity to capture their attention, build trust, and move them closer to a visit. However, this only works if your trade-in tool delivers a consistently good experience.

Early Valuations Must Be Quick and Simple

In order to keep shoppers on your site during these multiple check-ins, those early valuations need to be quick and simple for consumers to complete. If your trade-in tool requires extensive information—VIN, mileage, condition details, contact information, photos—before providing even a rough estimate, you’ll lose shoppers to competitors who offer instant valuations with minimal input.

The most effective trade-in tools follow a progressive information model:

- Initial estimate (30 seconds): Require only year, make, model, and approximate mileage to provide a broad range

- Refined estimate (2-3 minutes): Ask for VIN and condition details to narrow the range

- Final offer (in-person or with photos): Conduct full appraisal for your firm offer

This approach respects the shopper’s time during early research phases while still capturing enough information to provide useful estimates.

Valuations Must Be Backed with Real-Time Market Data

The valuations should be backed with real-time market data so the customer has realistic expectations. When shoppers check their trade-in value multiple times over weeks or months, they’re often comparing your numbers against Carvana, CarMax, and private party listings. If your valuations are based on outdated book values or don’t reflect actual market conditions, consumers will quickly identify the discrepancy and lose trust in your tool.

Real-time market data ensures that:

- Your estimates remain competitive with alternative buyers

- Shoppers see consistent valuations across multiple check-ins (unless market conditions genuinely change)

- Consumers develop realistic expectations about what their vehicle is worth

- Your final in-person offer aligns closely with the online estimate, reducing negotiation friction

Turning Repeat Visits Into Leads

Each time a shopper returns to check their trade-in value represents a warm lead opportunity. Smart dealerships use these repeat visits to:

Track engagement: Monitor which shoppers are checking values repeatedly and prioritize outreach to these high-intent consumers

Offer value-added services: After multiple checks, invite shoppers to schedule an in-person appraisal for a more accurate offer

Capture contact information strategically: Don’t require emails and phone numbers for the first valuation, but offer to save their information or provide alerts about value changes after the second or third check

Provide market context: Help shoppers understand why their vehicle’s value may fluctuate based on seasonal demand, market conditions, or inventory needs

The 57% of consumers who check their trade-in value multiple times are your most engaged prospects. By making each interaction fast, accurate, and valuable, you keep them on your site instead of sending them to competitors—and you dramatically increase the likelihood they’ll choose your dealership when they’re ready to trade.

Q4: Why Payment Calculators Frustrate Shoppers (And How to Fix Them)

The Hidden Friction in Your Payment Tools

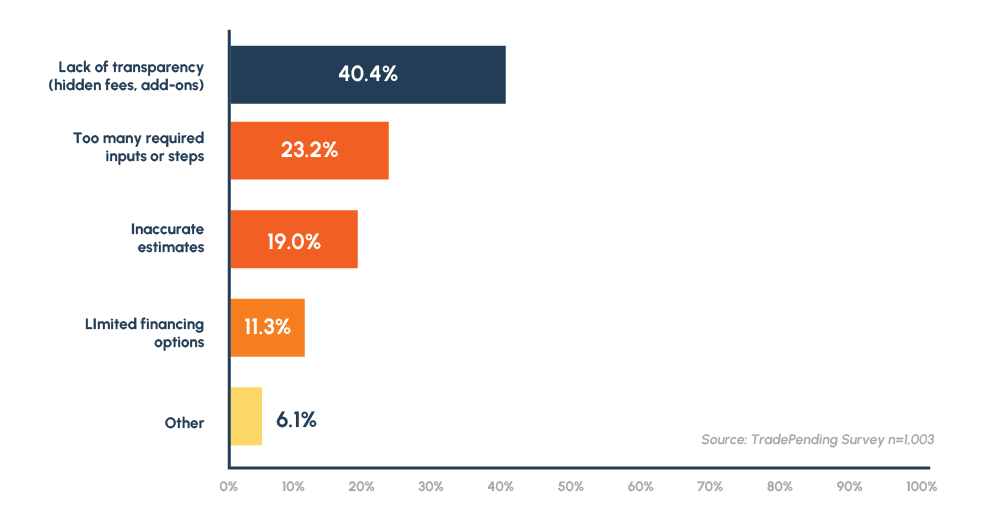

While 54.3% of consumers want to calculate payments on your website (Q1), traditional payment calculators often create more frustration than value. According to TradePending’s 2025 survey, when we asked shoppers what they find most frustrating about online car payment calculators, 40.4% cited lack of transparency around hidden fees and add-ons, 23.2% complained about too many required inputs or steps, and 19% reported receiving inaccurate estimates.

Question: When using an online car payment calculator, what do you find most frustrating?

The Top Frustrations Breaking Down

Lack of Transparency (40.4%): This stands out as the single biggest complaint about payment calculators. Shoppers receive an estimated monthly payment, get excited about affordability, then discover at the dealership that the actual payment is hundreds of dollars higher due to fees, warranties, insurance products, documentation charges, and other add-ons that weren’t included in the online calculation. This bait-and-switch experience destroys trust and sends consumers directly to competitors who they perceive as more honest.

Too Many Required Inputs (23.2%): Nearly one in four consumers abandon payment calculators because they demand excessive information upfront. Traditional calculators often require credit scores, down payment amounts, trade-in details, desired term length, and contact information before showing any payment estimate. Shoppers in early research phases don’t yet know these details and resent being forced to guess or provide personal information just to get a ballpark figure.

Inaccurate Estimates (19%): Even when shoppers complete lengthy payment calculators, many receive estimates that don’t reflect reality. This happens when tools use generic interest rates that don’t account for credit tier variations, fail to include typical fees and taxes, or make unrealistic assumptions about down payments and trade-in values. When the dealership’s actual numbers differ significantly from the online estimate, consumers feel misled.

Limited Financing Options (11.3%): Some shoppers want to compare different financing scenarios—various term lengths, down payment amounts, or lender options—but find that payment calculators don’t offer sufficient flexibility or show how these variables affect monthly costs.

Why Traditional Payment Calculators Create Problems

Online payment calculators that try to do too much end up too long, have too many steps, and set the wrong expectations before true creditworthiness is established, leading to significant customer frustrations. The fundamental issue is that most dealership websites treat payment calculators like finance applications rather than research tools.

Consider the typical shopper journey:

- Consumer sees a vehicle they like for $32,000

- They click “Calculate Payment” hoping for a quick answer

- Calculator demands: credit score, down payment, trade-in value, desired term, zip code, email, phone number

- Consumer either abandons (most common) or guesses at information

- Calculator shows $425/month based on perfect credit and aggressive assumptions

- Consumer visits dealership excited about $425 payment

- Dealer runs actual credit and quotes $575/month

- Consumer feels deceived and leaves

This scenario plays out thousands of times daily across dealership websites, damaging both individual sales and the industry’s reputation.

The Solution: Provide Payment Ranges to Early-Stage Shoppers

Providing a payment range to early-stage shoppers reduces or eliminates this friction. Instead of demanding extensive information to calculate a single “accurate” payment (which won’t actually be accurate anyway), show consumers a realistic range based on minimal inputs.

How Payment Ranges Work:

Minimal information required: Vehicle price, approximate trade-in value (optional), and rough down payment amount

Immediate range display: “Based on typical financing, your payment would range from $380-$520/month”

Clear explanation: Show what factors influence the range (credit tier, term length, actual down payment) without requiring those details upfront

No false precision: Acknowledge that the final payment depends on credit approval and dealer programs rather than pretending an online calculator can predict the exact amount

Benefits of the Payment Range Approach:

Reduces frustration: Shoppers get the affordability information they need in 30 seconds without extensive forms

Sets realistic expectations: A range accounts for credit variations and other factors, preventing the sticker shock that comes from overly optimistic single-number estimates

Builds trust: Transparency about what affects the final payment demonstrates honesty rather than trying to lowball consumers with unrealistic numbers

Increases engagement: More shoppers complete simple payment range tools than lengthy traditional calculators, giving you more opportunities to capture leads

Aligns with buyer journey: Early-stage shoppers don’t need (or want) precise payment calculations—they need to know if a vehicle fits their budget before investing time in detailed applications

When to Use Detailed Payment Calculators

Payment ranges work best for early-stage research. Once shoppers have identified specific vehicles they’re serious about, you can offer more detailed payment calculations that require additional information. This progressive approach matches the tool complexity to the shopper’s readiness level:

- First visit: Payment range with minimal inputs

- Return visit: More detailed calculator with trade-in and down payment specifics

- High-intent lead: Full credit application for accurate payment quotes

By addressing the 40.4% frustrated by lack of transparency, the 23.2% overwhelmed by required inputs, and the 19% receiving inaccurate estimates, you transform payment calculators from friction points into conversion tools. The key is recognizing that early-stage shoppers need affordability guidance, not precise payment quotes—and building your tools accordingly.

Q5: What Used Car Shoppers Really Want (And It’s Not What You Think)

Vehicle History Trumps Everything—Even Photos

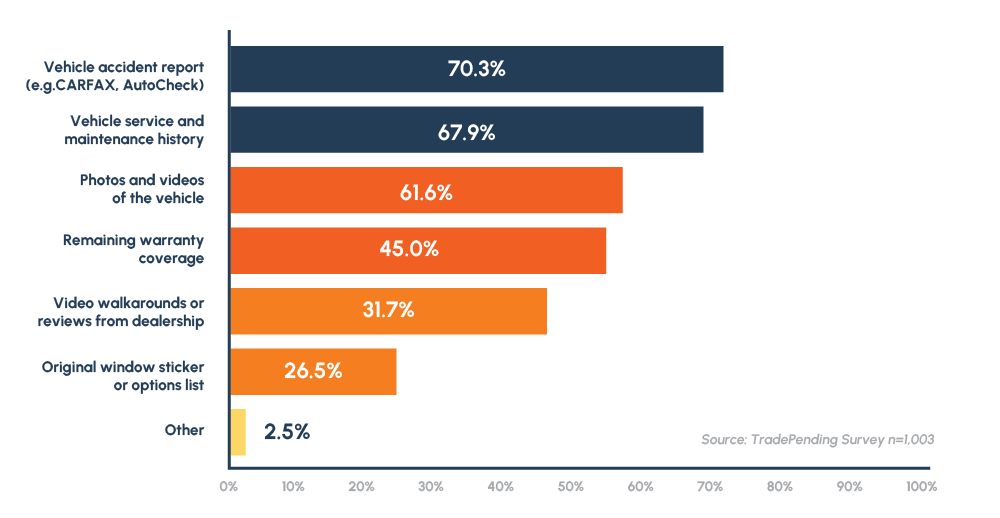

When researching used vehicles, consumers have clear priorities that may surprise many dealerships. According to TradePending’s 2025 survey of over 1,000 vehicle owners, 70.3% of shoppers rank vehicle accident reports (like CARFAX or AutoCheck) as most important, while 67.9% prioritize vehicle service and maintenance history. Photos and videos of the vehicle, which many dealers assume are the primary selling tools, ranked third at 61.6%.

The Complete Priority Ranking

The data reveals what used car shoppers genuinely care about when evaluating vehicles:

- Vehicle accident reports (70.3%): More than 7 in 10 consumers want to see CARFAX, AutoCheck, or similar reports showing whether the vehicle has been in accidents, had title issues, or suffered significant damage.

- Service and maintenance history (67.9%): Nearly as many shoppers prioritize seeing documented maintenance records, which signal that the previous owner took proper care of the vehicle.

- Photos and videos (61.6%): While still important to more than 6 in 10 consumers, visual content ranks below the vehicle’s history and maintenance documentation.

- Remaining warranty coverage (45%): Less than half of shoppers prioritize warranty information, though it clearly matters to those concerned about repair costs.

- Video walkarounds or reviews from dealerships (31.7%): About one-third of consumers appreciate guided tours, though this ranks well below basic photos and videos.

- Original window sticker or options list (26.5%): Only about one in four consumers cares about seeing the original window sticker, despite many dealers featuring these prominently.

Why Vehicle History Matters Most

Used car shoppers care most about the vehicle’s history, even more so than pictures and videos of the vehicle itself. This makes logical sense—photos show what a vehicle looks like now, but history reports reveal what it’s been through and predict future reliability.

Consumers have learned that:

- A clean accident history often matters more than pristine appearance

- Documented maintenance suggests ongoing reliability

- Title brands (salvage, flood, etc.) can dramatically affect value and insurability

- Service records help verify mileage accuracy and identify deferred maintenance

The 70.3% who prioritize accident reports and 67.9% who want service history are making informed buying decisions based on risk assessment rather than emotional response to appearance. This represents a more sophisticated used car market than existed even five years ago.

What This Means for Your Vehicle Listings

Providing all of this information for shoppers in one spot makes their research process faster and simpler while keeping them engaged with your brand. When consumers can find accident reports, service history, comprehensive photos, and warranty details all on your vehicle detail pages, they don’t need to visit third-party sites or competitors to complete their research.

Best Practices for Used Vehicle Listings:

Lead with history reports: Feature CARFAX or AutoCheck reports prominently at the top of each vehicle listing, not buried at the bottom or behind a click

Document maintenance: When available, display service records or note “Recently serviced” with specifics about what was done

Provide comprehensive photos: While not the top priority, 61.6% still want good visual documentation—aim for 20-30 photos showing exterior, interior, engine, wheels, and any notable features or flaws

Clarify warranty coverage: Clearly state whether factory warranty remains and what it covers, or whether you offer dealer warranties

Be honest about condition: Transparency builds trust—if there are minor issues or cosmetic flaws, note them rather than hoping shoppers won’t notice

Window Stickers: Not as Important as You Think

While sometimes important to dealers, consumers don’t highly value window stickers when researching used cars. Only 26.5% of consumers ranked original window stickers or options lists as important information. This suggests that dealers shouldn’t invest excessive effort in obtaining and displaying Monroney labels for used vehicles when that time could be better spent ensuring accident reports and service histories are available.

The Information Hierarchy for Maximum Engagement

Based on consumer priorities, structure your used vehicle listings in this order:

- Basic vehicle information: Year, make, model, mileage, price

- Accident and title history: CARFAX/AutoCheck report or link

- Service and maintenance records: Document what’s been done

- Photo gallery: Comprehensive visual documentation

- Key features and options: What comes with this specific vehicle

- Warranty information: What’s covered and for how long

- Video content: Walkarounds or detailed reviews (if available)

- Additional details: Window stickers, option codes, etc.

By prioritizing the information that 70.3% and 67.9% of consumers want first—accident reports and service history—you demonstrate respect for their research process and build trust faster than competitors who lead with sales pitches or flashy photos while burying the transparency consumers actually seek.

The message is clear: today’s used car shoppers want transparency and documentation before they want to be sold. Dealerships that provide comprehensive vehicle history information up front will capture and convert more leads than those that make consumers hunt for it or require phone calls to obtain basic reports.

Q6: The Surprising Power of Personalized Video

How Video Messages Influence Dealership Visits

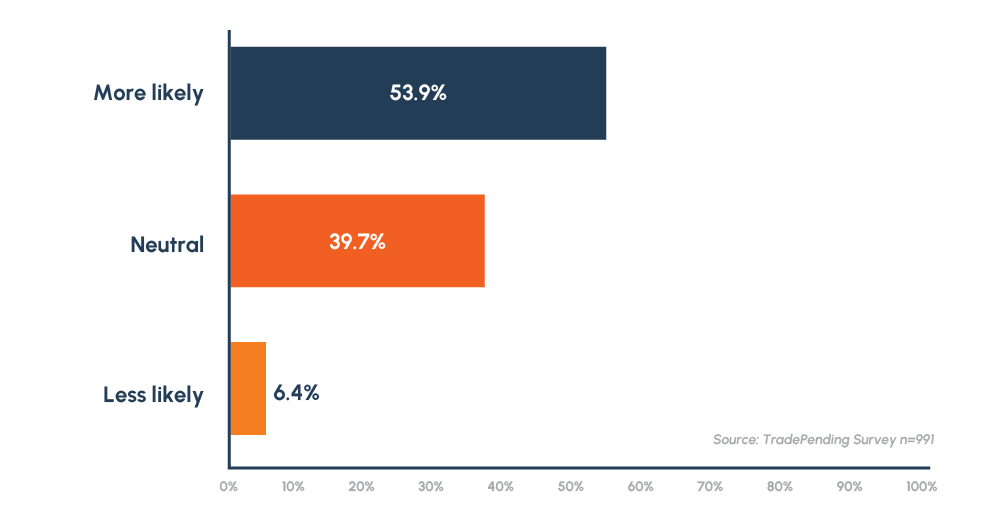

One of the most actionable findings in our research involves a relatively simple tactic: personalized video messages from salespeople. According to TradePending’s 2025 survey of over 1,000 vehicle owners, when we asked if receiving a personalized video introducing the salesperson and showing vehicles they’re interested in would affect their likelihood of visiting, 53.9% said it would make them more likely to visit, while 39.7% were neutral, and only 6.4% said it would make them less likely.

More Than Half of Consumers Respond Positively to Video

Over 50% of consumers say that a personalized video increases their likelihood of visiting a dealership. This represents a significant opportunity for dealerships willing to embrace video as a sales tool. The fact that video moves the needle for more than half of potential customers—while only negatively affecting 6.4%—makes it one of the most effective engagement tactics available.

Why Personalized Video Works

Using video in the sales cycle brings more people in while simultaneously speeding up the sales cycle. Several factors explain why video outperforms traditional text-based follow-up:

Human connection: Seeing and hearing a real salesperson creates personal connection that text messages and emails can’t match. Shoppers feel like they’re already working with someone rather than being processed by a faceless dealership.

Information efficiency: A 60-second video can convey more information and enthusiasm than multiple paragraphs of text, making it easier for busy consumers to engage.

Trust building: Video demonstrates transparency—shoppers can see the actual vehicles they’re interested in, the person they’ll work with, and the dealership environment, reducing anxiety about the buying process.

Differentiation: Since most dealerships still rely exclusively on emails and phone calls, video immediately differentiates your approach and signals that you’re willing to invest extra effort in each customer.

Convenience: Consumers can watch videos on their own schedule, pausing and rewatching as needed, rather than needing to take phone calls or schedule appointments just to get basic information.

The Neutral 39.7%: Not Opposed, Just Not Swayed

The fact that 39.7% of consumers are neutral about receiving personalized video shouldn’t be interpreted negatively. These shoppers aren’t saying video would hurt your chances—they’re simply saying it wouldn’t specifically increase their visit likelihood. For these consumers, video might not be the deciding factor, but it doesn’t create friction either.

This neutral segment means that sending personalized video has minimal downside risk. You’re not alienating prospects who prefer other communication methods; you’re simply adding an engagement layer that works exceptionally well for the 53.9% who respond positively while being acceptable to most others.

The Small 6.4% Who Respond Negatively

Only 6.4% of consumers say personalized video would make them less likely to visit. This small segment may include shoppers who:

- Prefer text-based communication they can quickly scan

- Feel uncomfortable being “targeted” with personalized content

- Don’t want to watch videos or have data/connectivity constraints

- Perceive video as overly salesy or invasive

However, this group is small enough that the benefits of video far outweigh the risks. Most successful sales tactics don’t resonate with 100% of consumers—what matters is whether the approach works for the majority, which video clearly does.

Implementing Effective Personalized Video

To maximize the positive impact video can have on your dealership visits, follow these best practices:

Keep it short: Aim for 60-90 seconds maximum. Introduce yourself, highlight 1-2 vehicles that match their interests, and invite them to visit or respond with questions.

Be authentic: Scripted, corporate-style videos don’t work. Speak naturally, smile, and let your personality show. Consumers respond to genuine people, not polished sales presentations.

Personalize meaningfully: Reference specific vehicles they’ve viewed, their stated preferences, or their trade-in details. Generic videos won’t generate the 53.9% positive response rate.

Send at the right time: Video works best as a follow-up to website engagement (vehicle views, trade-in valuations, payment calculations) or as a response to initial inquiries. Sending unsolicited videos to cold leads is less effective.

Include clear next steps: End every video with a specific call-to-action: “Click here to schedule your test drive,” “Reply with any questions,” or “I’ll follow up tomorrow afternoon if you’d like to discuss these vehicles further.”

Use quality equipment: You don’t need professional video production, but invest in decent lighting, clear audio, and stable footage. Poorly shot videos can undermine professionalism.

The Bottom Line on Video

With 53.9% of consumers saying personalized video increases their visit likelihood and only 6.4% responding negatively, video represents one of the highest-ROI engagement tactics available to dealerships. The challenge isn’t whether video works — our data proves it does — but rather implementing video processes that your sales team will actually use consistently.

Dealerships that systematically send personalized videos to engaged website visitors, incoming leads, and follow-up prospects will capture more appointments, shorten sales cycles, and convert at higher rates than competitors still relying exclusively on text-based communication.

Q7: Why 75% of Vehicle Owners Want Monthly Value Updates

The Retention Strategy Most Dealers Are Missing

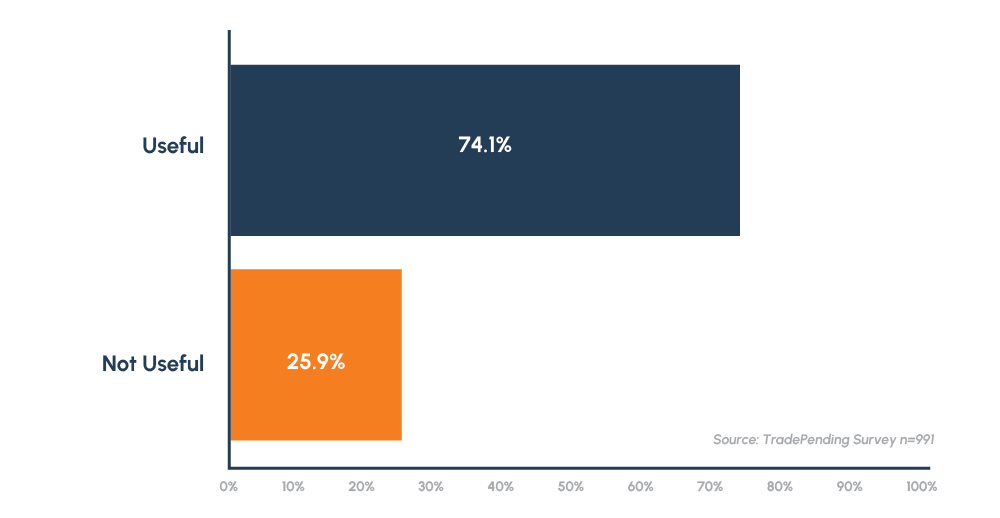

Dealerships invest heavily in acquiring new customers but often neglect their existing customer base and past leads. According to TradePending’s 2025 survey, when we asked vehicle owners how useful they would find receiving monthly updates about their car’s current value, 74.1% said they would find it useful, while only 25.9% said it wouldn’t be useful.

Nearly Three-Quarters of Consumers Want Regular Value Updates

Nearly 75% of vehicle owners find getting regular updates on their vehicle’s value useful. This represents a massive opportunity for dealerships to stay top-of-mind with both current customers and prospects who haven’t purchased yet. Even with Carvana leading the industry on this marketing technique, there remains a large opportunity for dealers to provide meaningful value to their current and future customers to nurture long-term relationships by adapting this same approach.

Why Value Updates Resonate with Consumers

The 74.1% positive response rate isn’t surprising when you consider what monthly value updates provide:

Financial awareness: Vehicle values fluctuate based on market conditions, and most consumers don’t actively track these changes. Regular updates help owners understand their vehicle’s worth without requiring them to actively research.

Planning assistance: Whether considering a trade-in, calculating equity, or timing a sale, knowing current vehicle value helps consumers make informed decisions.

Engagement without pressure: Unlike promotional emails or sales calls, value updates provide useful information without immediately asking for a commitment, which reduces consumer defensiveness.

Market context: Updates can explain why values are rising or falling (market trends, seasonal demand, new model releases), positioning dealers as helpful experts rather than just salespeople.

Trust building: Consistently providing accurate information over time builds credibility and keeps your dealership front-of-mind when consumers eventually enter the market.

Who Benefits Most from Value Updates

Vehicle value update programs serve multiple audience segments:

Current customers: Keep your service customers engaged and aware of their vehicle’s worth, creating natural opportunities to discuss trade-ins when equity positions improve.

Past leads: Re-engage shoppers who didn’t buy previously but may be ready now that their vehicle’s value or equity situation has changed.

Orphan owners: Reach vehicle owners in your market who purchased elsewhere but might be receptive to transparent value information and future business.

High-mileage drivers: Identify customers whose vehicles are depreciating quickly and may benefit from trading sooner rather than waiting until equity disappears.

What About the 25.9% Who Don’t Find It Useful?

About one in four consumers don’t see value in monthly updates. This segment likely includes:

- People who just purchased and don’t plan to trade for years

- Consumers who dislike any ongoing marketing communication

- Vehicle owners underwater on loans who don’t want reminders

- Those who prefer to research values only when actively shopping

However, the 74.1% positive response far outweighs this minority. Most successful marketing strategies don’t appeal to everyone—what matters is whether the majority finds value, which this clearly demonstrates.

Learning from Carvana’s Success

Carvana has successfully built a massive database of engaged consumers by offering instant online valuations and following up with regular value updates via email and text. Many consumers who have no intention of selling to Carvana still check their tool regularly because it’s fast, transparent, and provides useful information.

The opportunity for local dealerships is clear: you can provide the same value while also leveraging your competitive advantages—the ability to offer retail trade-in values, local market expertise, and existing customer relationships. When you combine useful value updates with superior offers, you win business that might otherwise go to online buyers.

Implementation Best Practices

To maximize the impact of monthly value update programs:

Make enrollment easy: Capture contact information through your website’s trade-in tool with explicit permission for ongoing updates

Provide real value: Use actual market data to show accurate values, not inflated numbers designed to generate false excitement

Explain changes: Don’t just show a number—explain why values increased or decreased based on market conditions

Include actionable insights: Note when equity positions improve, when timing is optimal for trades, or when values are holding strong

Respect preferences: Allow easy unsubscribe and honor communication preferences (email vs. text)

Connect to next steps: Include clear calls-to-action like “Get a firm offer,” “Explore trade-in options,” or “Schedule an appraisal”

Segment appropriately: Tailor frequency and messaging based on vehicle age, equity position, and engagement level

The 74.1% of consumers who find monthly value updates useful represent millions of potential touchpoints that most dealerships are completely ignoring. By adopting this proven retention and re-engagement strategy, you create ongoing value for consumers while systematically generating trade-in opportunities and staying top-of-mind for future vehicle purchases.

Q8: What Happens When You Send Regular Value Updates

The Actions Consumers Take (And Why It Matters)

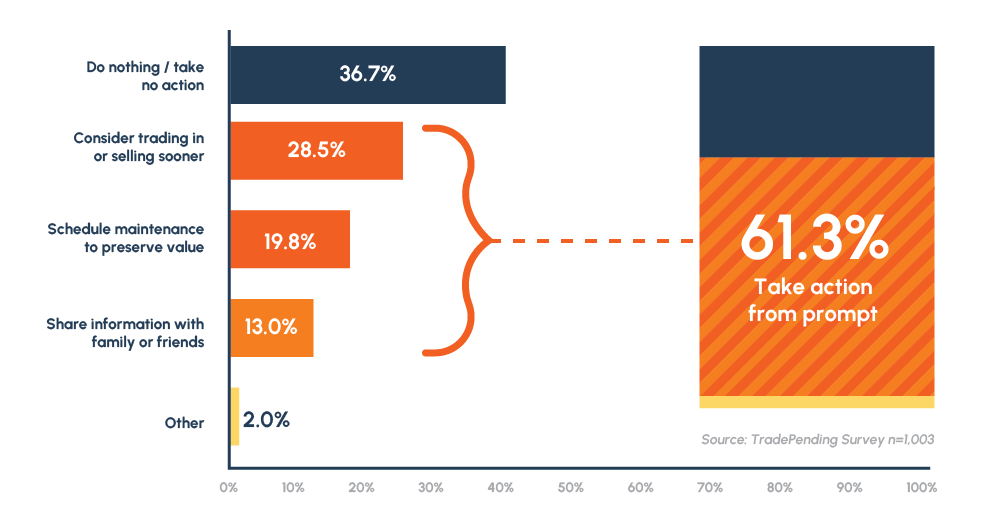

Skeptical dealers might ask: “Do value updates actually drive business, or are consumers just passively consuming information?” Our research provides a clear answer. According to TradePending’s 2025 survey, when we asked vehicle owners what action they would most likely take if they received regular updates about their car’s value, 63.3% indicated they would take some action, while only 36.7% said they would do nothing.

Breaking Down the Actions

Among consumers who would take action after receiving regular value updates:

Consider trading in or selling sooner (28.5%): More than one in four consumers say value updates would accelerate their trade-in or selling timeline. This represents direct revenue opportunity—these are vehicle owners who might wait another year or two before trading, but regular value awareness could motivate earlier action.

Schedule maintenance to preserve value (19.8%): Nearly 20% of consumers would respond to value updates by scheduling service work. This represents a direct path from value awareness to service revenue, especially for dealerships with service departments.

Share information with family or friends (13%): About 1 in 8 consumers would forward value updates to their network, effectively turning your communication into referral marketing that reaches potential customers you wouldn’t otherwise touch.

Other actions (2%): A small segment indicated they would take unspecified actions in response to value updates.

The Significant 36.7% Who Take No Action

More than one-third of consumers say they would do nothing with regular value updates. However, “doing nothing” doesn’t mean the program fails for these individuals. This group still benefits from:

Passive brand awareness: Even if they don’t click or respond, they see your dealership name regularly, keeping you top-of-mind when they eventually do need a vehicle.

Information banking: They’re building knowledge about their vehicle’s worth that may influence future decisions, even if they don’t act immediately.

Trust development: Consistently providing useful information without demanding action builds goodwill that translates into future business.

The fact that 63.3% take action while only 36.7% do nothing means that value update programs generate measurable returns beyond just passive awareness.

Why This Matters: Three Direct Revenue Streams

Sharing regular vehicle value updates with your customers speeds up both trade-in cycles and service work, while creating lasting brand awareness. The research reveals three distinct revenue opportunities:

1. Accelerated Trade-In Cycles (28.5%)

When consumers receive regular updates showing their vehicle’s value holding strong or their equity position improving, many decide to trade sooner than originally planned. This benefits dealers by:

- Bringing vehicles into the market earlier, while they still have strong retail appeal

- Capturing trade-ins before owners drive them into high-mileage, low-value territory

- Creating new vehicle sales opportunities with customers who weren’t actively shopping yet

- Reducing the average time between vehicle purchases in your customer base

2. Service Revenue Generation (19.8%)

The 19.8% who would schedule maintenance to preserve value represent a direct connection between value awareness and service department revenue. When consumers understand that regular maintenance protects their vehicle’s worth, they’re more likely to:

- Complete recommended services rather than deferring them

- Use dealer service departments rather than independent shops

- Address minor issues before they become major problems

- Maintain service relationships that lead to future parts and labor sales

This is particularly valuable for dealerships trying to recapture service customers who have drifted to independent shops or quick-lube chains. Value updates provide a reason to re-engage service customers beyond simply promoting specials or discounts.

3. Referral Network Expansion (13%)

The 13% who would share value information with family or friends effectively become unpaid marketing partners. Each value update you send has the potential to reach multiple additional consumers through social sharing, forwarding, and word-of-mouth. This organic reach carries more credibility than traditional advertising because it comes with implicit endorsement from trusted sources.

The Compound Effect Over Time

The true power of value update programs becomes apparent over 12-24 months rather than immediately. Consider a dealership that enrolls 5,000 consumers in monthly value updates:

Month 1-3: Most recipients are passive, though some early responders schedule appraisals or service Month 4-6: Trade-in consideration increases as consumers see value trends over time Month 7-12: Service uptake grows as maintenance reminders connect to value preservation Month 13+: Compounding effects emerge—referrals generate new enrollments, repeat customers re-engage, and brand awareness drives additional traffic

Dealerships that maintain consistent value update programs report that recipients are more likely to respond to other marketing, visit for service, and eventually trade vehicles compared to non-enrolled customers—even among those who initially appear to “do nothing” with the updates.

Implementation Considerations

To maximize the percentage of recipients who take action:

Personalize content: Generic value updates perform worse than those tailored to each consumer’s specific vehicle and situation

Vary messaging: Don’t send identical updates every month—highlight different aspects like market trends, optimal trade timing, service recommendations, or equity milestones

Create urgency appropriately: When values are declining or inventory is tight, note these conditions to motivate action without being manipulative

Make action easy: Every update should include one-click options to schedule appraisals, book service, or request current offers

Track and optimize: Monitor which messages drive the highest engagement and action rates, then refine your approach accordingly

The bottom line is clear: 63.3% of consumers will take some kind of action in response to regular vehicle value updates, with 28.5% potentially accelerating trade-in timelines and 19.8% generating service revenue. These numbers represent measurable ROI that far exceeds the minimal cost of maintaining a value update program.

Sharing regular vehicle value updates with your customers speeds up both trade-in cycles and service work, while creating lasting brand awareness that compounds over time.

Putting It All Together: Your Action Plan

How to Use These Insights to Transform Your Digital Strategy

TradePending’s 2025 consumer survey reveals clear patterns in what car shoppers want from dealership websites and which engagement tactics actually influence their buying decisions. Rather than guessing at what might work or copying competitors’ approaches, you now have data-backed insights to guide your digital strategy.

The Core Priorities: Focus on What Matters

According to our research of over 1,000 vehicle owners, three features dominate consumer priorities when visiting dealership websites: browsing inventory (68.8%), estimating trade-in values (56.5%), and calculating payments (54.3%). Everything else—service scheduling, test drives, online purchasing—ranks significantly lower and shouldn’t compete for primary attention on your homepage.

Immediate Action Items:

- Audit your homepage: Count how many calls-to-action currently appear. If you have more than 5-6 primary buttons, you’re creating decision paralysis rather than guiding shoppers toward conversion.

- Prioritize trade-in tools: With 56.5% wanting trade-in valuation and 57% checking values multiple times, your trade-in tool should be prominently featured and require minimal information for initial estimates.

- Simplify payment calculators: Address the 40.4% frustrated by lack of transparency and 23.2% overwhelmed by required inputs by offering payment ranges that require minimal information rather than lengthy applications.

- Highlight vehicle history: Feature CARFAX or AutoCheck reports prominently on every used vehicle listing, as 70.3% of shoppers rank accident reports as their most important research criteria.

The Trust Gap: Winning Back the 53.6%

More than half of consumers (53.6%) prefer trading with private buyers, Carvana, or CarMax over local dealerships. This represents your biggest opportunity for growth—these aren’t people who will never trade at dealerships; they’re consumers who currently perceive alternatives as more transparent, competitive, or convenient.

Strategies to Close the Gap:

- Emphasize transparency in all trade-in messaging and tools

- Provide instant online valuations backed by real market data

- Feature customer testimonials about competitive trade offers

- Clearly explain your process and why you can often beat online buyers

- Eliminate unnecessary steps that create friction in the trade-in experience

The Engagement Advantage: Video and Value Updates

Two relatively simple tactics show remarkable potential for increasing dealership visits and maintaining customer relationships:

Personalized video (53.9% more likely to visit): Start sending 60-90 second personalized videos to engaged website visitors, showing specific vehicles they’ve viewed and introducing the salesperson they’d work with.

Monthly value updates (74.1% find useful, 63.3% would take action): Implement a program that sends regular vehicle value updates to current customers, past leads, and engaged website visitors. This keeps your dealership top-of-mind while generating trade-in and service opportunities.

The Information Hierarchy Consumers Actually Want

When building or optimizing vehicle listings, respect the priority consumers demonstrated in this research:

- Vehicle history and accident reports (70.3%)

- Service and maintenance records (67.9%)

- Photos and videos (61.6%)

- Warranty coverage (45%)

- Everything else

Stop burying CARFAX reports at the bottom of listings or behind clicks. Lead with transparency, knowing that today’s used car shoppers prioritize history over appearance.

Measuring Success

As you implement changes based on these insights, track:

- Trade-in tool completion rates (aim to increase from current baseline)

- Payment calculator engagement (completion rates should rise as you simplify)

- Video response rates (monitor appointment bookings after personalized videos)

- Value update engagement (track opens, clicks, and resulting appointments)

- Conversion rate changes (measure whether these optimizations increase lead submissions and visits)

The Bottom Line

Car shoppers have told us exactly what they want: simple tools for researching inventory, valuing trade-ins, and calculating payments; transparent information about vehicle history; human connection through personalized video; and ongoing value through regular updates.

Dealerships that align their websites and engagement strategies with these priorities will capture more leads, convert at higher rates, and build stronger customer relationships than competitors still guessing at what consumers want. The data is clear—now it’s time to act on it.

Frequently Asked Questions About Car Shopping Behaviors and Dealership Websites

Frequently Asked Questions

According to TradePending’s 2025 survey of over 1,000 vehicle owners, the three most valuable features are browsing inventory (68.8%), estimating trade-in value (56.5%), and calculating monthly payments (54.3%). These features significantly outrank secondary options like service scheduling (46.8%) or test drive booking (41.1%).

57% of consumers check their vehicle’s trade-in value multiple times during the sales cycle, with 37% checking “a few times during the process” and 18.2% checking “regularly (every few days or weeks).” Only 27.8% check just once at the start, while 16.9% never check at all.

53.6% of consumers prefer alternatives to local dealerships when trading in their vehicles. This breaks down to 23.3% preferring private buyers, 14.6% preferring online buyers like Carvana, and 13.6% preferring national chains like CarMax. Only 46.4% would consider their local dealership first.

The biggest frustration is lack of transparency around hidden fees and add-ons (40.4%), followed by too many required inputs or steps (23.2%), inaccurate estimates (19%), and limited financing options (11.3%). These frustrations occur when payment calculators try to do too much rather than providing simple payment ranges.

Vehicle accident reports rank highest at 70.3%, followed closely by service and maintenance history at 67.9%. Photos and videos, while still important at 61.6%, actually rank third—below vehicle history documentation. Remaining warranty coverage (45%) and video walkarounds (31.7%) rank lower, while original window stickers matter to only 26.5% of shoppers.

Yes. 53.9% of consumers say receiving a personalized video introducing the salesperson and showing vehicles they’re interested in would increase their likelihood of visiting the dealership. Another 39.7% are neutral, and only 6.4% say it would make them less likely to visit.

74.1% of vehicle owners say they would find monthly updates about their car’s current value useful, while only 25.9% say they wouldn’t. This indicates strong consumer interest in staying informed about their vehicle’s worth over time.

63.3% of consumers would take some action in response to regular value updates, with 28.5% saying they would consider trading in or selling sooner, 19.8% saying they would schedule maintenance to preserve value, and 13% saying they would share the information with family or friends. Only 36.7% would take no action.

Dealerships should emphasize transparency in their trade-in process, provide instant online valuations backed by real-time market data, simplify the steps required to get offers, feature customer testimonials about competitive pricing, and clearly communicate their advantages over online buyers (such as the ability to offer retail trade-in values).

Focus your primary calls-to-action on the three features consumers ranked highest: inventory browsing, trade-in valuation, and payment calculation. Limit homepage buttons to 5-6 primary options rather than overwhelming visitors with every possible feature. Make these core tools fast, simple, and immediately accessible without requiring extensive forms or navigation.

About This Research

This survey was conducted by TradePending in Fall 2025 with 1,003 vehicle owners across the United States. Respondents were asked about their dealership website preferences, online shopping behaviors, trade-in decision-making processes, and engagement with various digital tools and marketing tactics. The findings provide actionable insights for automotive dealerships looking to optimize their digital presence and improve customer acquisition and retention.

For more information about how TradePending’s solutions help dealerships implement these research-backed strategies, visit TradePending.com or schedule a demonstration of our trade-in valuation, payment calculator, and video communication tools.