Why Trade Valuations Matter for Dealerships

Accurate trade-in valuations are crucial for both consumers and dealerships. While Kelley Blue Book (KBB) is a trusted name among consumers, its trade-in estimates often rely on historical data rather than real-time market conditions. TradePending, on the other hand, equips dealerships with real-time, localized data to generate accurate, transparent trade-in values that drive higher lead conversions.

This article compares TradePending vs. KBB’s Instant Cash Offer to help dealerships choose the best tool for their trade-in process.

What is Kelley Blue Book (KBB)?

Kelley Blue Book is one of the most recognizable names in vehicle valuation. Founded in 1926, KBB has long been a trusted source for understanding a vehicle’s worth. The platform provides estimates based on historical data and market trends, offering consumers a baseline understanding of their car’s potential trade-in or sale value.

However, while KBB’s historical reputation is strong, its methodology—based on aggregated and older data—may not always reflect the fast-changing realities of today’s car market.

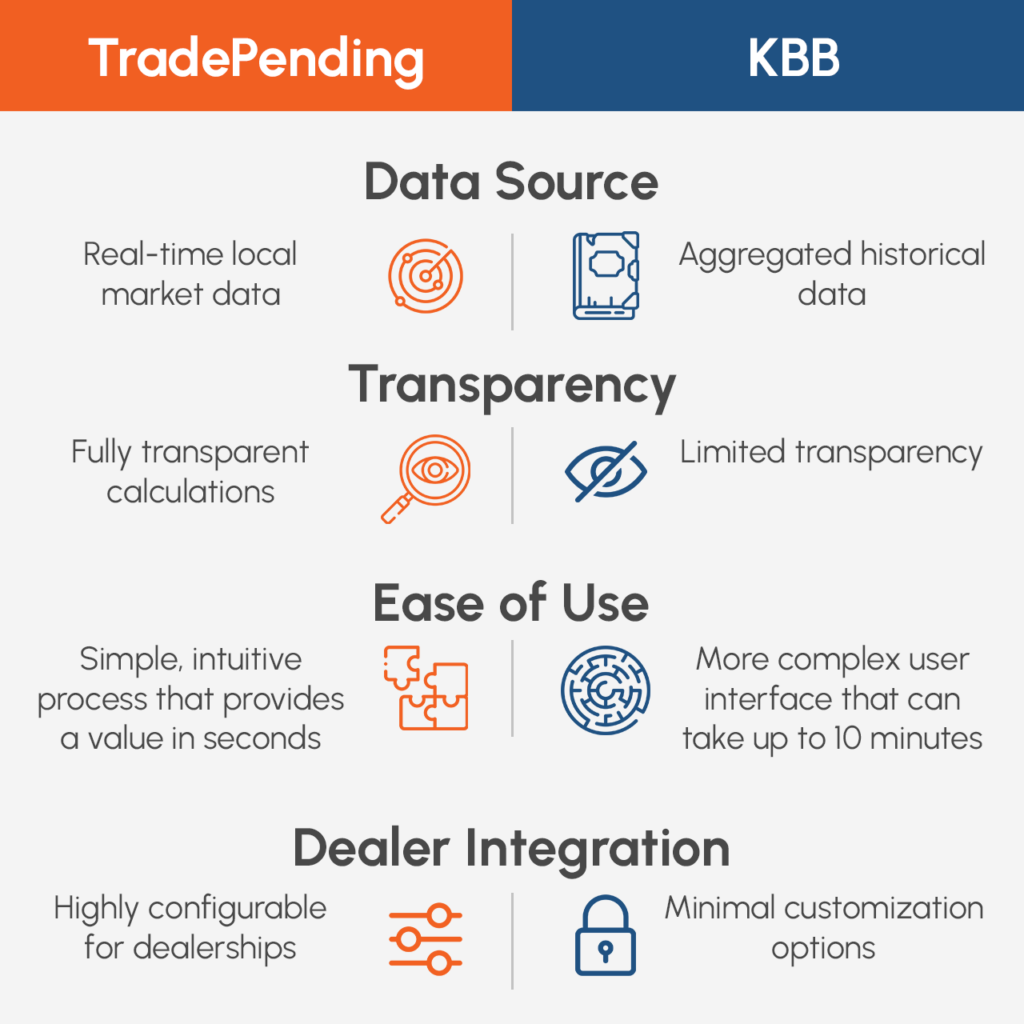

Key Differences: TradePending vs. Kelley Blue Book

To help dealerships quickly compare these tools, here’s a structured breakdown of their key differences:

|

Feature |

TradePending |

Kelley Blue Book (KBB) |

|---|---|---|

|

Data Source |

Real-time market data, dealership-configured |

Historical sales & auction data |

|

Intended User |

Dealerships looking to generate trade-in leads |

Consumers seeking estimated trade-in values |

|

Accuracy |

Dynamic, location-based valuations |

Static national & regional averages |

|

Lead Generation |

High-intent leads captured directly on dealership websites |

Leads directed to third-party buyers (unless you request this turned off!) |

|

Integration |

Fully integrates with dealership websites & CRM |

Limited dealership customization |

|

Customer Transparency |

All information shared with customer so they know how your dealership arrived at a value |

No explanation given for the value of their car. |

Key Takeaway: TradePending provides real-time, dealership-controlled valuations, ensuring accuracy and boosting trade-in lead conversion. In contrast, KBB’s consumer-focused approach relies on historical pricing, which can lead to unrealistic customer expectations.

Data Accuracy: Real-Time Market Values vs. Historical Averages

One of the biggest differences between TradePending and KBB is how they calculate trade-in values.

- Kelley Blue Book: Uses historical sales data, auction reports, and national pricing averages. This means values may lag behind actual market conditions, especially in a fluctuating inventory environment. Customers may receive a high estimate but get lower offers at the dealership, which creates distrust in the dealership, not KBB.

- TradePending: Uses real-time market data and allows dealerships to configure valuations based on their actual inventory needs. Dealers can adjust valuations dynamically to reflect local demand, leading to fewer discrepancies between online estimates and in-store offers.

Ease of Use: Which Trade-In Tool is More User-Friendly?

- TradePending: Offers a fast, mobile-friendly experience designed for dealership websites. Customers get a trade-in value in seconds, without leaving the dealer’s site, ensuring high engagement.

- KBB: Requires customers to navigate through multiple steps before receiving a trade-in estimate, and leads are often redirected to third-party buyers rather than the dealership.

Why it matters: A seamless, frictionless trade-in experience keeps shoppers engaged and leads them into the dealership’s sales funnel.

Impact on Dealership Trade-In Leads

TradePending is designed to increase dealership trade-in leads, while KBB often sends customers to competing retailers. Here’s why:

- KBB’s Instant Cash Offer can direct leads to multiple participating buyers, increasing the risk of losing the customer to a competitor. They will disable this, but you have to ask.

- TradePending keeps leads within the dealership by providing real-time trade values without outsourcing offers.

Case Study: One dealership using TradePending’s trade-in tool reported a 68% increase in trade-in leads compared to their previous KBB-based tool.

What Makes TradePending Different?

TradePending flips the script on traditional valuation methods by focusing on real-time, local market data. Here’s how it works:

- Website Conversions: TradePending makes it quick and easy for people to receive a value on their trade-in, typically in 10 seconds or less. KBB can take anywhere from 1 to 10 minutes. People abandon the process at much higher rates.

- Real-Time Data: Unlike KBB’s aggregated data approach, TradePending uses real-time local market data to deliver up-to-the-minute valuations. This ensures that the valuation reflects the current supply, demand, and market trends.

- Simple and Transparent: TradePending’s valuation process is straightforward and easy to understand. The platform shows users how their vehicle’s value is calculated and provides clarity on factors like mileage, condition, and location.

- Dealer Branding and Customization: TradePending integrates easily with dealer websites, offering branded, customized valuation experiences. This boosts customer trust and encourages higher lead conversions.

Why TradePending’s Approach Matters

In today’s fast-paced automotive market, consumers and dealers alike need accurate, real-time information. TradePending delivers this by:

- Improving Customer Confidence: Transparency and real-time data foster trust between dealerships and customers.

- Increasing Lead Conversions: TradePending’s integration with dealer websites streamlines the valuation process, keeping customers engaged.

- Adapting to Market Trends: By reflecting current market conditions, TradePending’s valuations are more relevant and actionable.

“The fact that TradePending isn’t some huge cookie-cutter brand is a huge plus. Customers accept Trade and trust it more. They see they’re going to get accurate values, not some lowball number controlled by a corporate decision maker.” – Jim Congdon, Burritt Motors. Read the full post here.

FAQs: Answering Common Dealership Questions

Is TradePending more accurate than Kelley Blue Book?

Yes. TradePending provides real-time, localized valuations based on actual dealership market conditions. KBB relies on national averages, which can often be outdated.

Does KBB send trade-in leads to dealerships?

KBB’s Instant Cash Offer allows customers to compare multiple offers from third-party buyers, meaning dealerships often compete with other retailers for the same leads.

Can dealerships control trade-in values with TradePending?

Absolutely. TradePending lets dealerships configure their own valuation parameters, allowing them to align offers with their inventory needs.

Conclusion

If your dealership wants accurate, real-time trade-in values that drive higher lead conversions and customer engagement, TradePending is the superior choice. While KBB is a well-known consumer brand, its reliance on historical data and third-party lead distribution often creates challenges for dealerships.

Next Steps: Ready to experience the difference? Schedule a demo to learn more and see how our tools can transform the car valuation process.