At the beginning of each year, we survey consumers and dealers to better understand what motivates them. The results: the more things change, the more they stay the same.

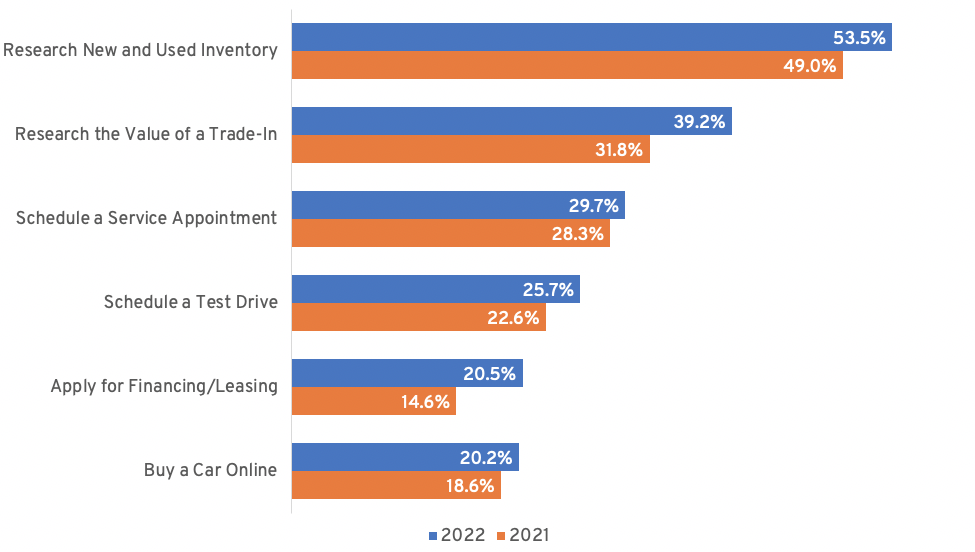

Consumers have more demand for seeking online information than ever before. This shouldn’t be a surprise given the last 20 months of pandemic-life. What’s really interesting is that we’ve asked the same question below for 8 years, and never have we seen this much of an across-the-board increase in consumers valuing these key engagement points.

Our first question gets at the heart of what people want to do when they visit a car dealership’s website. Pay attention! These are the items to optimize on your site. 🙂

When visiting an auto dealership’s website, what services would you value?

Methodology: conducted by Google Consumer Surveys, January 2022. N = 1,501.

Methodology: conducted by Google Consumer Surveys, January 2022. N = 1,501.

| Key takeaways | How to take advantage of this in 2022? |

| The top three reasons have stayed the top 3 since we first began this survey in 2015 | Examine your SRPs and VDPs. How can you present a shopping experience that’s different from every other out-of-the-box dealership website? What’s making your inventory stand out?Hint: check out Badges, which will increase engagement, while improving your sales talk tracks and gross. |

| Trade-in valuation interest is up 23% year-over-year! This trend is certainly fueled by national coverage of vehicle value inflation in 2021. It’s also 100% confirmed by our own 2021 engagement and conversion data which showed an average increase in website conversion for trade of 29.7%! | Utilize Trade and Offer to capture every used vehicle acquisition opportunity you can. Build a great process around working trade-in leads and streamlining your in-store “trade walk” and valuation process. |

| Time to feed the “service” machine | Sales-to-service opportunities for you may have been reduced in 2021 given low inventory levels. Examine your online scheduling tool, and make sure it’s optimized on mobile. Keep consumers in service and be prepared for the 3-5 year effect. Deploy a digital service experience! |

Digging deeper into the data from the “buy a car online” responses, we see that consumers continue to get more comfortable with the idea of completing some part of their vehicle purchases online.

So is it time for digital retailing to really take off? Maybe or maybe not, but this sentiment is on the rise. In our view you need to optimize it all, like your trade-in call-to-actions and payment calculations, while making sure your digital retailing sub-components synchronize their values with those solutions. Nothing is more frustrating for a customer than getting two different quotes on their trade-in or monthly payment from the same website!

So is it time for digital retailing to really take off? Maybe or maybe not, but this sentiment is on the rise. In our view you need to optimize it all, like your trade-in call-to-actions and payment calculations, while making sure your digital retailing sub-components synchronize their values with those solutions. Nothing is more frustrating for a customer than getting two different quotes on their trade-in or monthly payment from the same website!

Pro tip: Check out our TradePending API page for a list of digital retails tools we support. We’re happy to refer you to one. If you are using one that we’re already partnered with, request they use our API for vehicle valuations.

When shopping for a car, I would visit the following websites…

We ask that question above twice, but provide two different sets of answers to two different audiences. The first grouping compares local car dealerships to the 3rd party inventory listing sites.

When shopping for a car, I would visit the following websites…

Methodology: conducted by Google Consumer Surveys, January 2022. N = 1,430

Methodology: conducted by Google Consumer Surveys, January 2022. N = 1,430

The second group compares local dealerships to the big box and major online players.

When shopping for a car, I would visit the following websites…

Methodology: conducted by Google Consumer Surveys, January 2022. N = 1,405

Methodology: conducted by Google Consumer Surveys, January 2022. N = 1,405

Key takeaways for dealers:

- Given the strong proclivity of consumers to favor a local car dealer’s website, you better have a damn good website. You’re up against stiff competition from the major players.

- The aforementioned website better look good and convert better on mobile, since 60-70% of all website traffic comes from that source.

- Money spent driving traffic to your website versus third party websites is money well spent.

- Make sure you’ve got plenty of inventory in stock. The battle for used car acquisition continues to heat up as Carvana and competitors ramp up their marketing spend, with a focus on inventory sourcing.

- Learn from the big guys. Take their marketing tactics, and adapt them and make them your own.

In our final question, we turned to dealers to understand what matters most to them when it comes to trade-in tools.

Given that we’re the makers of Trade & Offer, the industry’s highest ROI website conversion tool for trade-ins and most configurable trade-in offer solution (respectively), this is an important question for us to understand.

Key takeaways: The clear winner across franchise and independent dealers is accuracy, which needs a bit of explanation.

Key takeaways: The clear winner across franchise and independent dealers is accuracy, which needs a bit of explanation.

- The ability for dealers to customize the valuation outcomes in order to reflect their actual costs to make a vehicle front-line ready is the true definition of accuracy in both the consumer’s and dealer’s minds. Having a penny perfect trade-in value is meaningless if it doesn’t take into account the actual cost for dealers to invest in a consumer-owned unit and to re-market it.

- Using local retail market data to determine a vehicle’s value, instead of national and regional averages that are irrelevant to a specific area, will always deliver more accurate vehicle valuations. We should remind folks that TradePending is the only valuation engine that is zip code centric!

- As expected, independent dealers are more price sensitive.

We’re again reaffirmed by the fact that very few dealers place value on having a household brand name be their trade-in tool. They instead value the things that matter most: accuracy, ease of use, conversion rates, and performance.